Can you accrue paid time off (PTO) on a zero hours contract?

When the conversation turns to the terms of employment and flexible working arrangements, the words “zero hours contract” can quickly ignite fiery debate. Celebrated by some for its flexibility, and criticised by others for perceived instability, these contracts have become a hallmark of the modern UK job market. But where does one of the most treasured employment benefits – Paid Time Off (PTO) – fit into this arrangement?

1.3 million UK workers are employed via zero hours contract.

This blog post aims to explain how holiday accrual works on a zero hours contract.

What is a zero hours contract?

In the UK, a zero hours contract is an employment agreement between an employer and an employee wherein the employer is not obligated to provide any minimum working hours, and the employee isn’t guaranteed any hours either. It’s essentially a ‘we’ll call you when we need you’ arrangement.

This type of contract can be an attractive proposition for students, retirees, or anyone seeking a flexible work schedule. However, because the hours are so unpredictable, the associated benefits can sometimes fall into a grey area.

What is paid time off (PTO)?

Paid Time Off is a holistic term that includes various kinds of leaves such as vacation, personal time, and sick leave, which an employee can avail without losing pay. Now, the fundamental query is: if you’re working on a zero hours contract, can you accrue PTO?

Can zero hours workers get paid time off (PTO)?

In the UK, the law states that all employees and workers – even those on zero hours contracts – are entitled to statutory annual leave. This means, despite the casual nature of their contract, zero hours workers are still protected by law to get paid time off.

How is paid time off (PTO) calculated on a zero hours contract?

The general rule in the UK is that workers are entitled to a minimum of 5.6 weeks of paid annual leave. For full-time employees, this translates to 28 days. But for zero hours contract workers, the calculation is a bit trickier.

Because their working hours fluctuate, their annual leave is typically calculated as a percentage of hours worked. For instance, an individual working on a zero hours contract accrues about 12.07% of annual leave for every hour they work. This is generally an easier way to calculate holiday accrual than relying on the previously used 52 week method – where an employee would have to look back at their working schedule over the last year.

For example, if Brenda worked 25 hours in a week, she’d accrue roughly 3 hours of paid leave (12.07% of 25 hours).

How to keep track of the hours an employee has worked

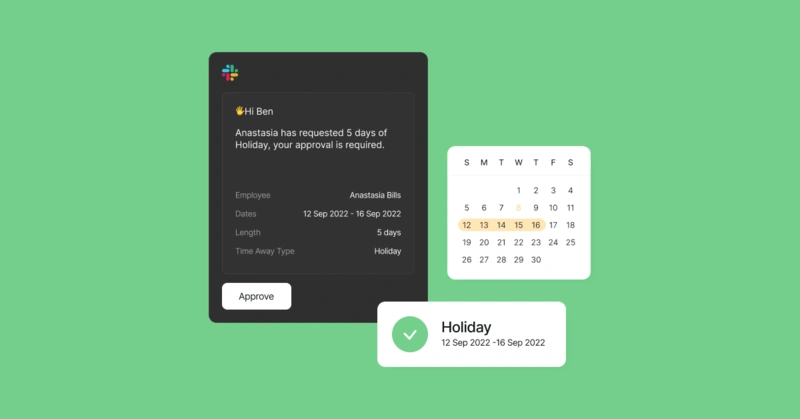

Many HR platform such as Zelt have the capability for employee to log timesheets to clock in and out of their work day. These can be configured for managers to approve or reject submitted times, and then automatically synced payroll.

For more niche use cases there a number of specialised tools, such as a time clock app with GPS if you need to keep track of employees location.

Complications of paid time off on a zero hours contract

Holiday carry over

Unlike some full-time contracts, unused leave from a zero hours contract might not always be carried over into the next year. This largely depends on the specific terms of the employment agreement.

Bank holidays

Zero hours contract workers have the same bank holiday rights as regular workers, but this doesn’t always mean they get a day off on a bank holiday or get extra pay for working on a bank holiday. Instead, the rights pertain to the proportion of bank holidays to the total annual leave, known as pro-rata entitlement. If you work some bank holidays, this should be factored into your annual leave entitlement.

Sick pay

While statutory sick pay (SSP) is a different beast altogether, it’s worth noting that zero hours contract workers can qualify for SSP, but the eligibility criteria can be stringent. Read more about it in our previous blog on statutory sick pay in zero hours contracts.

Payment in lieu (TOIL)

Some employers might offer an “in lieu” payment, which is essentially a payment made for the leave instead of the actual time off. However, this can only cover the time above the basic 5.6 weeks UK legal minimum.

On a zero hours contract, TOIL might accrue when a worker has put in more hours than usual over a short period, perhaps to cover a business surge or staff shortage. For instance, if an employer has an especially busy week and a worker ends up working many more hours than usual, rather than getting paid overtime, they might be offered TOIL.

Employees rights to be aware of

It’s essential for employees on zero hours contracts to be aware of their rights. Employers are required by law to provide a written document that lays out the terms of employment, and this should clearly state the rules about PTO accrual.

For employees, if you believe your rights are being violated, you can raise the issue with your employer or seek advice from an employment lawyer. Bodies like ACAS also offer guidance on such matters.

The dynamic of the employment landscape is ever-shifting, and the surge in zero hours contracts is testament to this change. While such contracts offer immense flexibility, understanding the nuances, especially when it comes to benefits like PTO, is crucial. Fortunately, in the UK, laws ensure that even the most flexible work arrangements don’t skimp on essential rights. So, whether you’re an employer or employee, staying informed will ensure a fair and fruitful working relationship.