South African Payroll with Zelt

In South Africa, managing payroll involves a meticulous process that entails various considerations, from calculating employee salaries to complying with local regulations. Understanding the intricacies of South Africa’s payroll system is crucial for businesses to ensure accurate and lawful payment processing.

Key Elements of South African Payroll

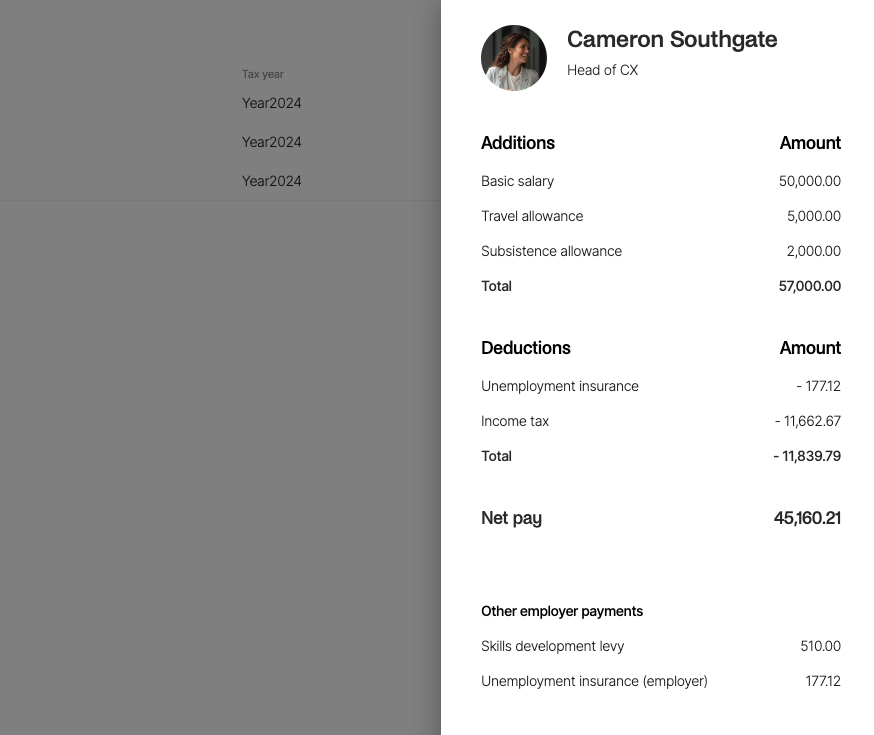

- Salary Structure: The salary structure in South Africa comprises components such as remuneration, net pay, basic salary, allowances, and benefits. Employers must discern between gross pay and gross deductions to accurately determine employees’ earnings and deductions.

- Setting Up Payroll: Establishing a payroll system in South Africa necessitates thorough knowledge of local employment laws. Companies must create a payroll calendar, develop a policy handbook for employees, and obtain an employer identification number. Employing a qualified payroll administrator and completing essential paperwork are essential steps in the setup process.

- Payroll Processing Steps: Processing payroll involves gathering pertinent employee documents, estimating gross and net pay, processing payments according to the established schedule, and maintaining accurate payroll records. Employers must also inform relevant authorities about deductions, including social security contributions and taxes.

- Payroll Contributions: Both employers and employees are required to contribute to payroll taxes in South Africa, including skills development levies and unemployment insurance. Understanding the tax rates and thresholds is crucial for accurate tax withholding and reporting.

Employer Payroll Contribution

| Particulars | Contribution Rate |

| Skills Development Levy | 1% |

| Unemployment Insurance | 1% |

Employee Payroll Contribution

| Particulars | Contribution |

| Unemployment Insurance | 1% |

Employee Income Tax

| Taxable Income | Rates of Tax (R) |

| 1 – 237,100 | 18% of taxable income |

| 237,101 – 370,500 | 42,678 + 26% of taxable income above 237,100 |

| 370,501 – 512,800 | 77,362 + 31% of taxable income above 370,500 |

| 512,801 – 673,000 | 121,475 + 36% of taxable income above 512,800 |

| 673,001 – 857,900 | 179,147 + 39% of taxable income above 673,000 |

| 857,901 – 1,817,000 | 251,258 + 41% of taxable income above 857,900 |

| 1,817,001 and above | 644,489 + 45% of taxable income above 1,817,000 |

Payroll Cycle: South Africa offers flexibility in choosing payroll cycles, with options for monthly or weekly payments. Additionally, companies are mandated to provide a 13th-month salary credited in December annually.

Payroll Options for Companies: Businesses operating in South Africa can opt for various payroll software options, including remote payroll, internal payroll administration, engaging South African payroll companies, or outsourcing payroll processing to global partners like Zelt.

Entitlement and Termination Terms: Employment contracts should outline entitlement and termination terms, including notice periods and severance pay obligations. South Africa’s labor laws stipulate provisions for leaves, minimum wages, and termination procedures, which must be adhered to by employers.

Entitlements and Termination Terms

Severance Pay: Employees are entitled to severance pay based on their years of service with the company. This transition payment, also known as severance pay, is provided when an employee’s job is terminated. However, severance pay is not applicable if termination is due to poor performance.

Leaves: South African employees are entitled to various types of leaves, including public holidays, maternity leave, sick leave, paternity leave, study leave, and injury leave. Maternity leave is unpaid and should not exceed four months, while sick leave is paid for up to 30 days for five-day workweeks or 36 days for six-day workweeks.

Minimum Pay: The minimum wage for employees in South Africa is 25.42 ZAR per hour, excluding overtime or other incentives.

How to process South African payroll in Zelt

Businesses seeking guidance in navigating South Africa’s payroll landscape can leverage platforms like Zelt to streamline payroll processing and ensure compliance with local regulations. Zelt offers support for payroll setup, tax compliance, and employee management, simplifying the complexities of payroll administration in South Africa.

Step 1: Calculate and finalise the payrun

Zelt will calculate payroll data based on tables as referenced above, automatically determining all statutory deductions including SDF, UIF and PAYE. Once you’re happy with the payrun, finalise it in the platform.

Step 2: Retrieve tax filing records

- Payslips generated for employees to access in their profile

- EMP201 generated for your e@syfile acccount (each month)

- EMP201 generated for your e@syfile acccount (year end)

Step 3: Accounting journal sync

Once your accounting software is connected you can automate the syncing of your journals via Zelt, or simply export a journal and import it to your accounting system.

Step 4: Make payments

Leverage Zelt’s payment infrastructure to process the payments to your team or download your import ready CSV to upload to your business bank

Step 5: Monitor Compliance and Tax Status

Track compliance status and tax liabilities using Zelt’s dashboard, staying informed about updates and communications from SARS and the UIF Commissioner.

Allowances you can take advantage of

In the realm of South African payroll management, two essential components often arise concerning employee remuneration and taxation: travel allowance and subsistence allowance. Understanding these concepts and their implications is crucial for both employers and employees. Let’s delve into each in detail, supplemented with examples to illustrate their application in real-world scenarios.

Travel Allowance

Definition: A travel allowance is a payment made by an employer to an employee to cover the costs associated with business-related travel.

Calculation: The calculation of a travel allowance depends on various factors, including the distance travelled, mode of transport, and applicable rates per kilometre. In South Africa, the South African Revenue Service (SARS) provides guidelines for calculating travel allowances based on the actual business kilometres travelled.

Tax Implications: Travel allowances are subject to tax, but certain portions may be deemed non-taxable if they meet specific criteria outlined by SARS. Employers must ensure accurate reporting and withholding of taxes on travel allowances to avoid compliance issues.

Example: Consider an employee who travels 500 kilometres for business purposes in a given month. If the applicable travel allowance rate is R3.98 per kilometre, the calculation would be as follows:

Travel Allowance

= Total Kilometres Travelled × Applicable Rate

= 500 km × R3.98/km

= R1,990

Subsistence Allowance

Definition: A subsistence allowance is a payment made by an employer to an employee to cover the costs of meals, accommodation, and incidental expenses incurred during business travel away from the employee’s usual place of residence.

Calculation: Subsistence allowances are typically calculated based on per diem rates prescribed by SARS. These rates vary depending on factors such as the destination and duration of travel.

Tax Implications: Similar to travel allowances, subsistence allowances are subject to tax. However, certain portions may be exempt from tax if they meet specific criteria outlined by SARS. Employers must accurately report and withhold taxes on subsistence allowances to ensure compliance with tax regulations.

Example: Suppose an employee embarks on a business trip to a neighbouring city for two days. If the prescribed subsistence allowance rate is R450 per day, the calculation would be as follows:

Subsistence Allowance

= Daily Rate × Number of Days

= R450/day × 2 days= R900.