The GTM to Engineering Ratio: How Early-Stage Startups Build for Growth

Where should early-stage start-ups invest in talent: building the product or taking it to market? We conducted an analysis in conjunction with HSBC Innovation Banking of 50 UK-headquartered Seed and Series A startups that raised between £10-20m in the past 12 months to dive into this questions.

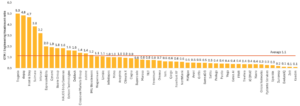

On average, the ratio of Go-to-Market (GTM) staff to engineering staff across these companies stands at 1.3x. This shows that, at this stage, companies are prioritising growth and customer acquisition—critical drivers for scaling—while still maintaining a strong engineering backbone.

Data Source: Crunchbase, LinkedIn, December 18th 2024

Let’s dig into the numbers.

The Numbers Behind the Ratios

The analysis ranks 50 startups by their GTM/Engineering ratios, and the data shows significant variation:

- The highest ratio comes in at 5.0 (Trogenix), signaling a heavy emphasis on GTM functions relative to engineering

- The median ratio sits at 0.8 and average at 1.3, with many companies maintaining near parity between GTM and engineering headcount such as Tilt

- At the lower end, the GTM/Engineering ratio is as low as 0.1 (Zelt and Kaedim), highlighting a more product-focused team composition

Such diversity indicates that while some startups are going “all-in” on sales, marketing, and customer-facing roles to capture market share, others remain focused on product development and engineering innovation.

Interestingly, the companies at the higher end of the scale—like dopay (4.8) founded in 2014—may already have mature products and a more mature offering overall, enabling them to invest aggressively in their GTM engines. Conversely, startups with lower ratios may still be perfecting their products before ramping up customer acquisition, or have found a way to acquire customers without large investments into GTM headcount.

Why Does This Matter for Startups?

At the seed and Series A stages, raising capital is often predicated on achieving strong product-market fit and early customer traction. The data shows that startups averaging a 1.3 GTM/Engineering ratio are leaning into the challenge of growth. They’re building out teams focused on sales, marketing, and customer success to turn great products into revenue.

This trend reflects the critical shift from “build” to “scale” at this funding stage. It’s no longer just about having an innovative solution—it’s about getting that solution into the hands of customers and proving its value at scale.

Striking the Right Balance

While there’s no universal “perfect” ratio, the data underscores the importance of balance. Startups need strong engineering teams to deliver on product promises, but those efforts are wasted without GTM teams ready to bring that product to market.

For investors, founders, and operators, this analysis serves as a benchmark:

- Are we investing enough in growth to capture market share?

- Is our GTM team mature enough to support the scale we’re targeting?

- Are we building the right balance of product innovation and market execution?

A Data-Driven Approach to Scaling

Ultimately, this analysis highlights a key reality for startups looking to scale: customer acquisition and product development are two sides of the same coin. Early-stage teams must remain agile, balancing engineers who build the product with GTM teams who bring it to market.

However, not all startups scale their GTM efforts in the same way. Some are innovating their go-to-market strategies, leveraging automation and technology to keep their GTM teams lean without sacrificing growth.

Many startups just hire more marketers and sales reps to drive growth,” says Chris Priebe, Founder of Zelt. “Instead, we built a programmatic, AWS-based system that finds prospects online, personalises outreach, and scales infinitely. It pulls from all our CRM data, automates campaigns across digital and physical channels, and helped us achieve an LTV/CAC ratio of 25x while cutting our burn multiple to 0.3x.”

By benchmarking your own team composition against these insights, startups can make smarter hiring and strategic decisions—fueling both product innovation and market growth.