Employer NI Calculator and Guide for 2025/26 UK

Use this Employer NI Calculator (updated 21/04/2025) to calculate Employer National Insurance Contributions (NICs), find out how much employers have to pay and the amounts which employees get deducted from their pay.

Note: While this NI calculator NI can handle both calculations for employed staff and company directors, the article below focuses on the calculation method for employees. If you want to learn more about company directors you should refer to our dedicated directors NI calculator page instead.

Employer NI Calculator – Estimate Your NIC for 2025/26

You are responsible for contributing to National Insurance on behalf of your employees as an employer. These are the payments that are separate from your employees’ salaries and are due to HMRC on a regular basis.

At Zelt, we enjoy making tax calculators.Our Employers NI contributions calculator makes it easy to estimate NIC you will need to pay for new and existing employees. It helps you budget accurately, stay compliant, and understand the full cost of employment for each tax year up to 2025/26.

What is Employer National Insurance?

Employer National Insurance Contributions (NICs) are taxes that, as an employer, you pay on top of your employees’ wages. These contributions help fund services like the NHS, state pensions, and other social security benefits and it’s a government requirement for businesses with employees.

Types of National Insurance Contributions

Class 1A NICs: This is paid once a year. It is for extra things (called “benefits”) that the company gives to workers, like:

- A company car

- Health insurance

- A mobile phone from work

These things are like extra money in the eyes of the government. So, the company has to tell the value of these things at the end of the tax year and pay 15% of that value as NIC. (Before, it was 13.8%.)

Class 1B NICs : Sometimes, a company makes a deal with the tax office called a PAYE Settlement Agreement. This helps the company pay one single amount for all the small or unusual gifts or things given to workers.

For example, if a worker gets a gift or a treat, instead of counting each one, the company can pay all tax and NIC for them in one go.

This makes things easier for the company.

Talk to an expert

Speak to us to learn how you can integrate your benefits offering with payroll.

Overview of recent National Insurance changes

Below is a summary of changes in the last years for NI category A.

| Date | What changed | Employee NI | Employer NI |

|---|---|---|---|

| Nov 2022 | Base rate Base threshold Higher rate |

13.25% → 12% £823 → £1,048 3.25% → 2% |

15.05% → 13.8% |

| Jan 2024 | Base rate | 12% → 10% | |

| Apr 2024 | Base rate | 10% → 8% | |

| Apr 2025 | Base rate | 13.8% → 15% £9,100 → £5,000 |

Increase in employer NI contributions from 6 April 2025

Starting from April 6 2025 the employer NI rate will increase from currently 13.8% to 15% and the employer NI threshold (secondary threshold) will reduce from currently £9,100 per year / £758 per month to to £5,000 per year / £417 per month.

As a result employers will pay more National Insurance contributions in the tax year 2025/26 as illustrated in the table below for a number of different annual salaries.

| Annual salary | Employee NI | Employer NI |

|---|---|---|

| £30,000 |

£1,393.92 +0 |

£3,749.40 +£865 |

| £40,000 |

£2,193.96 +0 |

£5,249.40 +£985 |

| £50,000 |

£2,993.88 +0 |

£6,749.40 +£1,105 |

| £60,000 |

£3,210.00 +0 |

£8,249.40 +£1,225 |

| £70,000 |

£3,410.04 +0 |

£9,749.40 +£1,345 |

| £80,000 |

£3,609.96 +0 |

£11,249.40 +£1,465 |

| £90,000 |

£3,810.00 +0 |

£12,749.40 +£1,585 |

| £100,000 |

£4,010.04 +0 |

£14,249.40 +£1,705 |

Did you know you can save up to £1,000 in National Insurance per year by using a Salary Sacrifice pension scheme? Learn more about saving National Insurance with a Salary Sacrifice pension.

How is National Insurance calculated?

This guide walks you through the fundamentals of the employer National Insurance calculation using NI rates and thresholds and showing a few examples.

In this section, we’ll go over the rules behind the National Insurance contributions calculation and how they differ between employees and employers. In particular, this article looks at

- National Insurance categories

- National Insurance rates

- National Insurance thresholds

- National Insurance threshold calculator

The National Insurance category

In order to calculate NI deductions correctly, you need to assign an employee the correct National Insurance category.

There are 8 broad employee National Insurance categories, which are dependent on personal factors such as age, marital status and employment history such as having another job, being an apprentice or a veteran.

This table lists the NI categories for 2024 as per gov.uk

| NI Category | Employee Group |

|---|---|

| A | Default NI category for all employees unless classified otherwise |

| B | Married and widowed women who are eligible for reduced NI contributions |

| C | Employees who are over the State Pension age |

| H | Apprentices under the age of 25 |

| J | Employees who are paying their NI contributions through another job |

| M | Employees under the age of 21 |

| V | Army Veterans in their first employment |

| Z | Employees under the age of 21 who are also paying their NI contributions through another job |

Most employees have NI code A, which is the default National Insurance category and applied to anyone who does not fall into any of the other NI categories listed in the below NI category letter table.

Note that the National Insurance number (NINO) has nothing to do with the NI category, as its a random identifier for HMRC for a tax person in the UK, which never changes, while the NI category of a person may change over time.

How to calculate employers National Insurance contributions (NI Class 1)

Calculating employers National Insurance is straightforward: employers pay 0% on income below a certain threshold and 13.8% above that threshold. Use this NI calculation UK formula:

Employers NI = National Insurance rate x Income above NI threshold

For the most common NI classes (A, B, C and J) this threshold is the Secondary Threshold. For certain young employees (H, M) and veterans (V) the income threshold is the much higher Upper Earnings Limit.

National Insurance rates for Employers

Use this table to determine employer National Insurance rates for 2024/25 UK (effective from 6 January 2024). Multiply any earnings above the threshold by the National Insurance rate, shown in the table below, to get the employer National Insurance you need to pay for an employee.

| NI Category | National Insurance rate below threshold | National Insurance rate above threshold |

|---|---|---|

| All NI categories | 0% | 13.8% |

National Insurance threshold for Employers

Use this table to determine National Insurance thresholds 2024/25 effective from 6 January 2024. Income above these thresholds is subject to employers NI contributions at the NI rate determined above.

| NI category | NI threshold (annually) | NI threshold (monthly) | NI threshold (weekly) |

|---|---|---|---|

| A, B, C, J | £9,100 | £758 | £175 |

| F, I, L, S | £25,000 | £2,083 | £481 |

| H, M, V, Z | £50,270 | £4,189 | £967 |

Table with NI calculations for 2025/26

Below you can see monthly employer and employee NI contributions for the tax year 2025/26 for a range of salaries ranging between £30,000 and £90,000 per year relevant for employees with NI category letters A, B, C and J.

This employee NI calculator has been used to calculate employee NI deductions. These are taking into account the latest NI rates and income thresholds effective from 6 April 2024 onwards.

| Annual Salary | Monthly Employee NI | Monthly Employer NI |

|---|---|---|

| £30,000 | £116.16 | £312.45 |

| £35,000 | £149.49 | £374.95 |

| £40,000 | £182.83 | £437.45 |

| £45,000 | £216.16 | £499.95 |

| £50,000 | £249.49 | £562.45 |

| £55,000 | £259.17 | £624.95 |

| £60,000 | £267.50 | £687.45 |

| £65,000 | £275.83 | £749.95 |

| £70,000 | £284.17 | £812.45 |

| £75,000 | £292.50 | £874.95 |

| £80,000 | £300.83 | £937.45 |

| £85,000 | £309.17 | £999.95 |

| £90,000 | £317.50 | £1,062.45 |

National Insurance credits

Employers which had less than £100,000 in employers NI in the past tax year have an annual employment allowance of £5,000 in the 2024/25 tax year, which can be deducted from employers NI when paying HMRC. These National Insurance credits, renew every tax year, as long as you stay below the total NI threshold, subject to change.

Starting from the 2025/26 tax year the £100,000 threshold will be scrapped, so that every employer can make use of the allowance. Additionally, the allowance is increaed to £10,000 per year to counteract the overall increase in employer NI costs, benefitting particularly smaller and medium sized employers.

Employee benefits and in some cases expenses are also subject to National Insurance

There are a few more things you need to take into considerations in order to account for other income subject to National Insurance, such as benefits and some expenses. There are also more things to considers for directors and PAYE settlement agreements.

Employers Class 1A NI contributions on employee expenses and benefits

National Insurance is also payable on any employee benefits in kind or expenses. Employers must report and pay this particular NI liability at the end of the tax year, or pay it throughout the tax year via payroll.

You must pay NI on benefits such as work phones, accommodation, and bonuses. Note that every expense and benefit is calculated differently, so you need to check on what you’re required to report and pay.

You will need to complete a P11D form for every employee that you have given benefits or expenses to and return it to HMRC. It is possible to deduct and pay class 1A NI through your payroll as long as you remember to register with HMRC before the beginning of the tax year.

NI Contributions for directors of limited companies

Company directors count as employees and therefore are required to pay NI contributions on any income over £9,100. Your NI liability is calculated from annual earnings but is paid in accordance with your payroll schedule.

Even if you’re the only employee of your company and you’re the director, your company will still need to pay employers NI on your salary.

Class 1B NI – PAYE Settlement Agreement (PSA)

A PSA allows employers to make a single payment per year that covers any tax and National Insurance contributions that are due on ‘minor, irregular or impracticable’ employee expenses or benefits. These are known as Class 1B National Insurance contributions. Benefits that are covered include long service incentives, telephone bills, relocation expenses, and shared cars.

How much do I deduct from employee pay for National Insurance contributions (NI Class 1)?

As an employer, you are also responsible for automatically deducting your employees’ NI contributions from their pay as part of NI Class 1 contributions. Most employees are on NI letter A which has a free income threshold of £1,048 and NI rates A consisting of

8% for income between £1,048 and £4,189 per month

2% on income above £4,189

The NI rates and thresholds for 2024/25 are shown in the NI category letter table below. For further information on employee NI contributions and how much NIC you need to deduct from employee pay you can refer to our dedicated employee NI calculator article for employed staff specifically.

| Category Letter | up to £1,048 | £1,048 to £4,189 | Over £4,189 |

|---|---|---|---|

| A, F, H, M, V | 0% | 8.0% | 2.0% |

| B, I | 0% | 1.85% | 2.0% |

| J, L, Z | 0% | 2.0% | 2.0% |

Final Thoughts

Once you wrap your head around it, the National Insurance hike, though costly, is straightforward. That being said, with the income thresholds having changed several times in a short period of time, a robust payroll process is necessary.

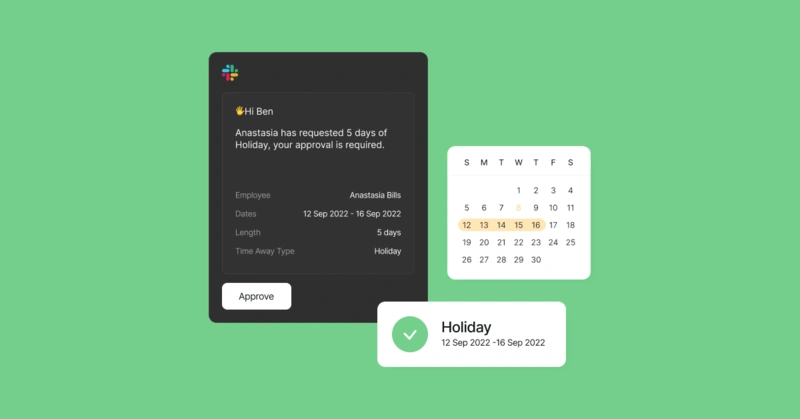

Your payroll software should be able to implement the changes to the National Insurance calculation seamlessly. Not only should these changes in NI be reflected automatically, but you should be able to communicate directly with your employees in order to explain and contextualise any National Insurance changes they see on their payslips, which will help you improve the employee experience.

Finally, if you are unsure about how much you have to pay, our Employer NI Calculator can simplify everything. You can also explore methods of reducing your NI bill that might benefit both you and your employees.

Frequently Asked Questions

How much National Insurance do I pay?

How much National Insurance you pay is impacted by factors around how much you earn and your employment status. If you are an employee under the State Pension age and earn more than £242 a week you and your employer pay Class 1 NI contributions. They’re automatically deducted by your employer from your pay, and employers pay an additional employer NI contribution on top.

Do employers pay National Insurance in the UK?

Yes, they do. Employers deduct their employees’ National Insurance contributions and pay on their behalf. In addition, employers pay an additional National Insurance contribution on their employees’ earnings above the relevant threshold.

How much NI does an employer pay in the UK?

It depends on the National Insurance category of your employees but for most employees in the tax year 2024/25, employers need to pay a 13.8% contribution on any employee earnings exceeding the secondary threshold, which is £175/week or £758/month.

What percentage is National Insurance?

For employees with NI class A, the NI threshold is £1,048 below which you pay 0%. Between £1,048 and £4,189 employees pay 8% and above that 2% on their income.

Do employers pay NI for employees in the UK?

UK employers are required to deduct their employees’ national insurance contributions as well as paying their own contributions ‘employer national insurance’ on their employees’ earnings.