10 Best Payroll Software in the UK 2026: Top Tools Compared

Running payroll in the UK shouldn’t feel like a monthly fire drill, but for many HR and Payroll teams, it still does.

If you’re managing payroll in a small or mid-sized business, you’re probably dealing with keeping up with ever-changing HMRC rules, timesheets being submitted late, payroll calculations and adjustments done manually. And you’re expected to get it all right, on, time, every time. This is exactly why more UK businesses are moving to modern payroll software — tools that reduce manual work, prevent errors, and make payday predictable rather than stressful.

To help you choose the right one for your business (yes, there’s no such thing as a one-size-fits all solution. Although we still think we’re the best!) , we’ve studied the 10 best payroll software in the UK for 2026 and compared their features, strengths and pricing.

Quick Overview: Best Payroll Software in the UK (2026)

If you don’t want to go into details, here’s a quick comparison:

| Platform | Strengths | Best For | Starting Price |

|---|---|---|---|

| Zelt | Unifies HR + Payroll + T&A in one platform | Growing UK SMEs with hybrid workforces | From £5/user/month |

| Zellis | Enterprise payroll & compliance | Large UK organisations | From £6/user/month |

| BrightPay | Simple, HMRC-compliant, accountant-friendly | SMEs & payroll bureaus | From £1.25/month |

| ADP Payroll | Global scalability, complex payroll | Scaling or multinational businesses | From £26/month |

| Sage Payroll | Reliable, integrates with Sage | SMEs using Sage tools | From £7/employee/month |

| BambooHR + Payroll | HR + payroll in one | Mid or large global companies | From £7/user/month |

| Payfit | Simple & automated payroll | Small UK businesses | From ~£34/user/month |

| MHR (People First) | Accurate, strong analytics | Medium to large UK companies | From £7/user/month |

| Moorepay | Managed payroll service | Companies preferring outsourced payroll | From £1.90/user/month |

| QuickBooks Payroll | Good for with QuickBooks users | Small UK businesses | From $15/month |

Pricing is indicative based on publicly available information; please confirm with the vendor for the latest rates.

What is Payroll Software?

Payroll software is a digital solution that helps businesses automate and streamline employee payments, including calculating wages, deductions, and taxes, and ensuring compliance with local tax laws. It handles pay calculations, transferring funds to employees, and reporting payroll information to tax authorities like HMRC.

According to research, businesses are adopting payroll software very quickly. In 2024, the market was worth $35 billion, and by 2034, it could reach $91 billion. However, the biggest step forward in recent years is that leading UK platforms like Zelt Payroll no longer treat payroll as a separate system. Instead, payroll sits on top of live HR data, so when someone is onboarded, changes role, logs overtime or books time off, those updates are reflected automatically in payroll.

However, when it comes to choosing the right solution, most comparison sites focus on generic features. But if you’re the one responsible for payroll actually running smoothly each month, you’re probably asking more practical questions like (great questions to ask during demos!):

- How much manual data entry will this actually remove?

- Will this reduce errors, or just move them somewhere else?

- Does it handle UK-specific compliance without constant checking?

- Can managers and employees self-serve instead of emailing HR?

- Does this connect with HR, time tracking, expenses and benefits?

So, what should HR & Payroll leaders actually look for in UK Payroll Software?

UK Payroll Software: Key features & requirements

When you compare payroll provider, it’s important to focus on specific criteria and features that affect daily use and long-term efficiency:

- Natively integrates with HR: Centralises HR, accounting and time-tracking processes so employee records, leave, benefits, and timesheets sync automatically. Reduces manual data entry and gives a full workforce view.

- Pricing structure: Check cost structure, per user, per employee, or flat fees. Look for predictable pricing without hidden costs. Consider add-ons like cloud access, reporting, or mobile apps.

- Ease of implementation: Should be easy to set up and use. Look for onboarding guides, tutorials, and good customer support. Less learning time means faster benefits.

- Automatic tax tiling: Handles PAYE, National Insurance, and auto-enrolment automatically. Ensures accurate submissions and reduces penalties.

- Employee self-service: Employees can view payslips, update personal information, and request leave online.

Top 10 Payroll Software in the UK [2026 edition]

Below is a closer look at the best payroll software platforms for UK businesses in 2026 – what they do well, where they’re strongest, and what type of company they’re best suited for.

1. Zelt

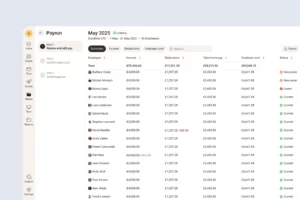

Zelt is an HMRC-approved payroll platform designed for UK small to medium-sized organisations who want to simplify, automate and centralise their employee processes across HR, time & attendance and Payroll. Zelt reduces errors and cuts payroll processing time from days to minutes by collecting employee information at the source and keeping everything in one system.

What customers say

“With Zelt, all the relevant payroll calculations are completed, tax information sent to HMRC, accounting journals

published and pension contributions submitted before you are passed to your bank to make payments. Relative to our old system, Zelt saves me at least a few hours each week.”

Charlotte T, Saasy People

Key Features:

- Integrated HR + payroll: Employee changes, time off, hours, benefits and salary updates automatically flow into payroll.

- HMRC-recognised payroll: RTI submissions, PAYE, NI, tax codes and student loans handled directly in Zelt.

- Support for shift and hourly workers: Overtime rules, custom pay codes and bulk timesheet handling.

- Self-service portal: Employees can see payslips, update details, view tax and deduction breakdowns.

Strengths:

- Truly unified HR + payroll + T&A, built natively to keep data in sync by default

- Faster and more accurate payroll due to automated data collection

- Designed for UK companies who want to remove the siloes between HR & Finance

- Modern, clean interface that managers and employees actually like using

- Enterprise-grade security and compliance

- Supports UK, GCC, and selected European/APAC regions for multi-region teams

Limitations:

- Smaller teams may not need full HRIS

- Best value when you use it as your core HR and payroll system – less suited if you only want a standalone payroll tool

Pricing:

Zelt’s modular pricing scales with your team. Plans start from around £5 per user per month, depending on the modules you choose (HR, payroll, performance, IT, etc.).

See how Zelt brings payroll, HR, and people management together in one connected platform.

2. Zellis

Zellis is an enterprise-grade payroll and HR solution for large UK organisations, combining advanced compliance, reporting, and real-time payment capabilities.

Key Features:

- 400+ automated UK-specific compliance checks

- Real-time Faster Payments

- 200+ ready-made payroll & HR reports

- Integrated HR modules (performance, rewards, pensions)

Strengths:

- Powerful for complex payrolls

- High automation ensures compliance

- Deep integration with enterprise HR systems

Limitations:

- Expensive for smaller businesses

- May require specialist implementation and training

- Not ideal for lean payroll-only setups

Pricing:

Starts at ~£6/user/month for smaller teams; custom quotes for larger organisations.

3. BrightPay

BrightPay is a trusted UK payroll tool, ideal for SMEs and accountants. It offers strong HMRC compliance, predictable licensing, and an optional cloud add-on for remote access.

Key Features:

- RTI, PAYE, National Insurance, and auto-enrolment support

- Cloud add-on for dashboards, self-service, and reporting

- Custom payroll reports and easy data export

- HMRC-recognised compliance

Strengths:

- Predictable annual license with no hidden fees

- User-friendly and streamlined for UK payroll

- Excellent for small businesses and accountants

Limitations:

- Desktop-based unless cloud add-on purchased

- Not suitable for large global enterprises

- Limited HR features

Pricing:

Starts from ~£1.25 / month. Annual license model; cost depends on edition and employee numbers.

4. ADP Payroll

ADP is a global payroll provider with a strong UK presence. It offers automation, employee self-service, and scalability across business sizes.

Key Features:

- Automated payroll scheduling, tax, and compliance

- Employee web portal for payslips and info updates

- Extensive reporting with access levels

- Scalable across geographies

Strengths:

- Trusted global brand

- End-to-end payroll automation

- Ideal for scaling or global businesses

Limitations:

- More expensive than UK-only tools

- Can be complex to configure

- Small teams may need longer onboarding

Pricing:

Starts from £26/month. Custom / quote-based, depending on size and modules.

5. Sage Payroll

Sage Payroll integrates closely with Sage Accounting and automates tax, payslip generation, and compliance for SMEs.

Key Features:

- Automatic PAYE, NI, and HMRC-compliant calculations

- Payslip generation and reporting

- Integration with Sage Accounting

- Supports auto-enrolment and pensions

Strengths:

- Reliable and well-known in the UK

- Seamless integration with Sage financial tools

Limitations:

- Less modern UI than cloud-native tools

- Limited advanced HR features

Pricing:

Starts from $7/employee/month. Subscription-based, varies by tier and employee numbers.

6. BambooHR + Payroll

BambooHR is primarily an HR platform that adds payroll functionality for an integrated solution suitable for SMEs.

Key Features:

- Unified HR + payroll platform

- Automated tax and payroll processing

- Employee self-service (payslips, personal info)

- Cloud-based with mobile access

Strengths:

- Excellent user experience

- Combines HR and payroll

- Scalable for growing teams

Limitations:

- Payroll less advanced than dedicated solutions

- Pricing increases with HR + payroll bundle

- Less suited for large or global payrolls

Pricing:

Starts from £7/user/month. Custom / quote-based depending on chosen modules and team size.

7. Payfit

Payfit is a cloud-native UK payroll system designed for simplicity, automation, and HMRC compliance.

Key Features:

- Real-time payroll updates and “undo” feature for corrections

- Automated pension submissions and PAYE reporting

- Integrations with accounting and HR tools

- Customisable payroll reports

Strengths:

- Easy to use and fast to set up

- Flexible and scalable for small to medium UK businesses

- Cloud-native, accessible anywhere

Limitations:

- Cost increases as team size grows

- Advanced HR features only in higher plans

- Optional faster payments cost extra

Pricing:

- Light plan: from ~£34/month (base fee + per employee)

- Standard plan: from ~£65/month (base fee + per employee)

- Premium plan: from ~£126/month (base fee + per employee)

8. MHR (People First)

MHR People First serves medium to large UK companies with accurate payroll, real-time insight, and compliance.

Key Features:

- 99.98% payroll accuracy guarantee

- Real-time dashboards for costs, headcount, and trends

- CIPP/IPASS-qualified payroll support

- International payroll if required

Strengths:

- Highly accurate and reliable

- Strong workforce analytics

- Suitable for complex payroll needs

Limitations:

- Higher cost than simpler tools

- Onboarding can be involved

- Best for larger businesses

Pricing:

Starts from £7/user/month. Estimated £200–£1,000+ per month depending on scale.

9. Moorepay

Moorepay offers a managed payroll service with integrated software, ideal for businesses preferring outsourcing.

Key Features:

- Dedicated PAS-accredited payroll professionals

- Automatic updates for UK legislation

- 24/7 support and custom reporting

- Integrated HR suite

Strengths:

- Hands-on support model

- Great for companies avoiding in-house payroll

- Expertise in UK payroll compliance

Limitations:

- Likely more expensive

- Less control for internal payroll teams

Pricing:

HRMS module starts at £1.90/user/month. Fully bespoke, based on company size and service level.

10. QuickBooks Payroll

QuickBooks Payroll is designed for UK SMEs using QuickBooks Accounting, integrating payroll seamlessly into financial workflows.

Key Features:

- RTI, PAYE, National Insurance, auto-enrolment compliant

- Direct deposit to employee bank accounts

- Employee self-service portal

- Sync with QuickBooks Accounting

Strengths:

- Efficient for QuickBooks users

- Reliable and UK-compliant

- Easy for non-experts

Limitations:

- Additional cost on top of QuickBooks

- Not robust for large/complex payrolls

- Limited enterprise analytics

Pricing:

Starts from $15/mon. Subscription plus per-user/employee fees depending on plan and employee numbers.

How to Choose the Right Payroll Software for Your Business

Choosing the right payroll solution is an important decision. The right tool can save you time, reduce mistakes, and help your business grow. Here’s a step-by-step guide to help you make the best choice:

Review Your Business Needs

Think about how many employees you have and how complex your payroll is. Do you have hourly workers, shift-based staff, or international employees? Consider what tasks you want the software to handle, like tax calculations, pensions, or benefits. Knowing your specific needs helps you avoid paying for features you don’t need.

Decide on a Budget

Payroll system comes in many price ranges. Some tools charge per employee, per month, while others have a fixed annual licence. Decide how much you can spend and balance cost with features. Remember, sometimes paying a bit more upfront can save you time and errors later.

Compare Different Features

Look at the features each payroll management software offers. Key features to compare include automated payroll calculations, employee self-service portals, tax filing, reporting, and integrations with accounting or HR systems. Make sure the software meets your current needs and can handle tasks you may need in the future.

Think About the Future

Choose software that can grow with your business. If you plan to hire more staff or expand globally, ensure the system can scale. Picking a flexible tool now saves you from switching systems later, which can be time-consuming and expensive.

Automate Payroll Processes with Zelt Payroll

Managing payroll manually can be time-consuming and there is always a chance of mistakes. Especially when you have to handle multiple employees, benefits, timesheets and taxes. This is where modern payroll software like Zelt becomes helpful. Zelt is one of the best payroll providers in the UK. With flexible pricing, it makes the process faster, simpler and more reliable.

You can automate your entire payroll process with Zelt’s HMRC-recognised payroll and HR platform, from employee onboarding to offboarding. It is an all-in-one HR solution for teams who want to combine payroll, benefits and performance management in a single system. Zelt reduces payroll processing from hours to just minutes and gives your team more time to focus on other important tasks.

Frequently Asked Questions

What are some examples of the best payroll software in the UK?

Popular UK payroll software includes Zelt, BrightPay, Zellis, ADP Payroll, Sage Payroll, Staffology, and MHR People First. These tools support HMRC compliance, automate payroll and suit businesses of different sizes.