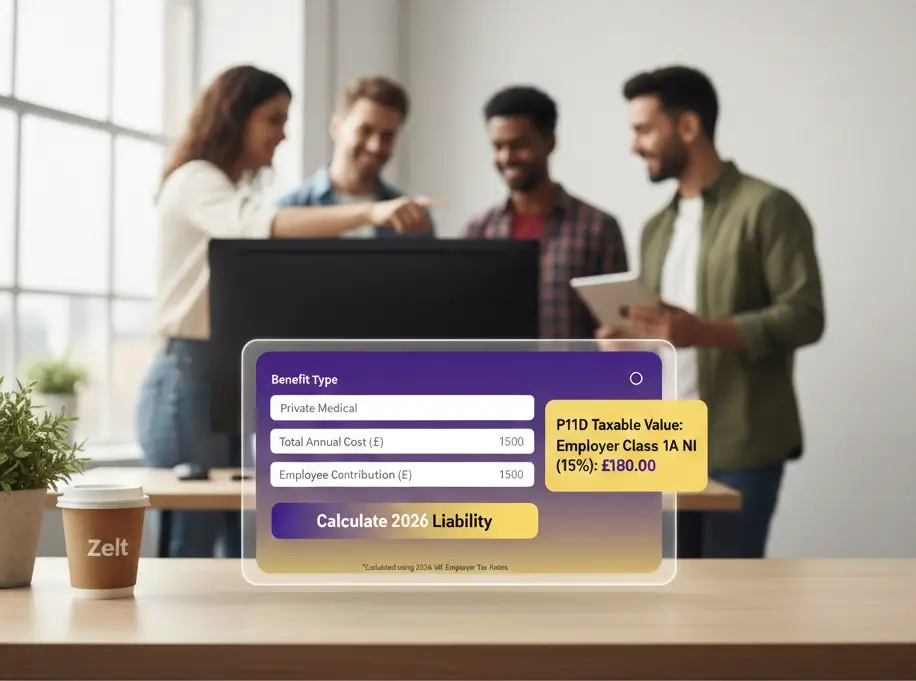

P11D Calculator for UK Employers: 2026 BIK Tax Rates

Providing perks like private health insurance, a company car, or a gym membership is a great way to keep your team happy. But for HR managers and business owners, these “non-cash” rewards come with a bit of a headache: Reporting them to HMRC.

| Setting | Value | Unit |

|---|---|---|

|

Benefit type

Total annual benefit

Employee contribution

|

|

–

£ per year

£ per year

|

| P11D taxable value | — | per year |

| Employer Class 1A NI | — | per year |

| Note: Simplified estimate; Class 1A NI rate may vary by tax year. | ||

If you don’t payroll these benefits in real-time, you must use a P11D form. Use our updated 2026 P11D calculator to calculate your Class 1A NI liability, stay compliant and avoid expensive fines.

Key Data Points: What HR Needs for Accurate Reporting

To use a P11D calculator correctly, you can’t just guess the numbers. You need specific records. Unlike a car tax calculator (which focuses on CO2), a general P11D report needs:

- Pro-rata Dates: If an employee joined mid-year, you only calculate the benefit from their start date.

- Asset Values: If you gave an employee a company laptop for private use or furniture, you need the market value.

- Employee Contributions: Keep receipts of any amount the employee paid towards the benefit, as this reduces your tax bill.

What is a P11D Form?

A P11D is a statutory tax form used by UK employers to report “Benefits in Kind” to HMRC. These are items or services you provided to your employees (or their families) that weren’t included in their normal paycheque. It ensures that the correct amount of Income Tax and National Insurance is paid on those perks.

What is Included in a P11D?

The form is divided into different sections (from A to N). Some of the most common items you need to report include:

- Private Medical Insurance: The most common benefit for many UK businesses.

- Company Cars & Fuel: This requires the car’s P11D value and CO2 emissions.

- Interest-Free Loans: Specifically, “beneficial loans” that exceed £10,000. loans under £10,000 total are usually exempt from P11D reporting.

- Assets Provided: Such as giving an employee a smartphone or a laptop for significant private use.

- Non-Business Travel: Expenses for holidays or personal travel paid by the company.

How to Submit a P11D to HMRC?

The days of posting paper forms are officially over. Since April 2023, HMRC requires almost all employers to submit P11D and P11D(b) forms online.

With HMRC’s Online Service You can manually type in the details for each employee on the HMRC portal. This is fine for 1–2 employees but becomes a nightmare for larger teams.

P11D vs. P11D(b): What’s the Difference?

This is a common point of confusion for many managers. Here is the simple breakdown:

- P11D Form: This is an individual record. You must file one for every single employee who received a benefit. It tells HMRC what they owe in income tax.

- P11D(b) Form: This is your company summary. It calculates the total Class 1A National Insurance (The Class 1A NI rate is 15% for 2026/27 tax year) that you as the employer must pay on all benefits combined.

Need to see how these perks affect your staff’s take-home pay? Check out our Benefit in Kind (BIK) Calculator to calculate Class 1A National Insurance and PAYE charges on employee non-cash benefits.

The Compliance Calendar: Deadlines & Penalties

In the world of HR, timing is everything. Mark these dates in your calendar:

- 6th July: This is the hard deadline to submit P11D forms for the previous tax year.

- 22nd July: This is the deadline to pay the Class 1A National Insurance you owe (if paying electronically).

The Risk of Waiting: If you are late, HMRC can fine you £100 per 50 employees for every month the form is late. Errors in calculation can also lead to heavy penalties, which is why using a verified P11D calculator is a lifesaver.

By April 2027, HMRC is making it mandatory to “payroll” all benefits. This means the yearly P11D spreadsheet exercise will disappear, and benefits will be taxed in real-time every month.

Conclusions

Finalizing your P11D reporting doesn’t have to be a stressful race against the July 6th deadline. While a P11D calculator is a great first step to estimate your tax bill and ensure accuracy, the move toward mandatory payrolling in 2027 means that manual spreadsheets are quickly becoming a thing of the past.

By staying ahead of deadlines and using the right tools like to track your benefits like Zelt all-in-one HR software in real-time, you protect your business from HMRC penalties and keep your team’s compensation ansparent and compliant.

Talk to an expert

Speak to us to learn how you can integrate your benefits offering with payroll.

Frequently Asked Questions

Do I need to file a P11D if there are no benefits?

No, if you didn't provide any perks, you don't need to file. However, you might still need to submit a "nil return" if HMRC specifically asks for one.

What is a P11D(b)?

The P11D(b) is the summary form. It tells HMRC the total amount of Class 1A National Insurance you need to pay across your whole company.

Can employees see their P11D?

Yes, you are legally required to give them a copy so they can check their own tax records.

Does a P11D calculator handle electric cars?

Yes! Electric cars have much lower tax rates, and a good calculator will apply the correct percentage based on the car's CO2 levels.