Overtime Calculator 2025/26 | Calculate Overtime Pay

Use this Overtime Pay calculator (updated 21/04/2025) to calculate Overtime Pay accurately for tax year 2025/2026.

| Day | Start Time | End Time | Break (mins) | Total Hours |

|---|---|---|---|---|

| Mon | ||||

| Tue | ||||

| Wed | ||||

| Thu | ||||

| Fri | ||||

| Sat | ||||

| Sun | ||||

| Total Weekly Hours | 0h 0m | |||

|

Hourly Rate Regular Pay (set cap) Overtime Pay |

£ h x |

£0.00 £0.00 |

||

| Total Weekly Pay | £0.00 | |||

Download Overtime Pay Calculator for Excel

To view how these values are calculated and compare tax years, you can download the Excel calculator by entering your details to receive it via email. Spot an error or have feedback? Let us know.

What is overtime pay?

Overtime refers to any hours worked by an employee beyond their normal working hours as defined in their employment contract. Usually, this term is used for the payment received for working extra hours.

What are the types of overtime?

Below are some types of overtime that both employees and employers should know:

Compulsory Overtime

This overtime is part of the job contract, and employees have to work overtime when employers offer it, but according to UK work time regulations.

Non-Guaranteed Overtime

In this type of overtime, the employer does not have to offer overtime, but when it is offered, the employee must accept it. For example, in a busy season, if an employer offers overtime, then the employee must accept it to manage the workload and cannot refuse it.

Voluntary Overtime

In voluntary overtime, the employer can ask about the overtime, but the employee can refuse to work the extra shift because in this type of overtime, it is not part of the contract.

Overtime Pay

In the UK, an employer is not legally obliged to pay overtime, but if an employee works extra hours, then you should ensure that the total pay is not below the minimum wage.

Time Off in Lieu (TOIL)

Instead of giving money for extra hours, the employer gives an extra day off to the employee, which is called time off in lieu (TOIL).

What is time-and-a-half?

Commonly, overtime pay is also called overtime premium or overtime rate of pay. The most usual rate of paying for extra hours is time and a half, which is 50% more than the employee's standard wage. In simple words, it is the employee's usual rate with the addition of half rate.

For example, if someone normally earns £10 per hour, then:

Time and a half = £10 × 1.5 = £15 per overtime hour

So if they work 2 extra hours:

2 × £15 = £30 extra pay

The overtime law in the UK

Mandatory Overtime

The employment contract will specify the details regarding overtime pay as employers are not required by law to pay an employee for overtime work. A contract may specify that an employee needs to work overtime without additional pay. However, the employee's average hourly pay cannot fall below the National Minimum Wage and an employee cannot be forced to work for more than 48 hours per week on average unless there is a signed agreement between the employee and employer. It must be noted that unless a contract guarantees overtime, the employer can reject an employee's request to work overtime as long as it's not discriminatory i.e. some employees allowed to work overtime and others not.

Paid Overtime

Employers will generally pay part-time staff for overtime if at least one of the following three applies:

- The employee works longer hours than those stated in the employment contract

- The employee works more than normal working hours of full time staff and full time staff would receive extra pay for working such hours

- The employee works at unsocial times (e.g. late at night) and full-time staff would get extra pay during these hours

Can I refuse to work overtime?

Employees only have to work overtime if your employment contracts says so. Even if it does, by law, you cannot usually be forced to work more than an average of 48 hours per week. An employee can agree to work longer, however, this agreement must be in writing and signed by the employee.

How to calculate overtime pay

Below you can find a quick explanation of how our overtime calculator works. The calculator works out the employee weekly pay and working hours and divides the two to find the employee’s hourly pay. It then multiplies the hourly wage rate by the number of overtime hours worked and the multiplier to find the overtime pay.

Determine earnings basis

State the employee earnings and the frequency of such earnings (i.e. annually, monthly, weekly or daily)

Enter regular working hours

State the employee’s regular working hours and the the interval over which the employee works these hours (i.e. weekly or daily)

Set regular work schedule

If either the earnings or the regular working hours frequency is daily, we need the number of days an employee works during a week to calculate the weekly earnings and/or the weekly working hours. As said above, the calculator divides the weekly pay by the weekly working hours to find the employee’s hourly pay

Set an overtime multiplier

This is the premium (if any) that is applied to the normal wage rate. For example if an employee earns £20 per hour and for overtime working hours the employer pays a 50% premium (i.e. multiplier = 1.5), the employee gets paid £30 for each hour of overtime work. If the employer does not pay any premium, then the multiplier is 1

Enter overtime hours worked

The number of hours an employee worked overtime. This is multiplied by the employees’ hourly rate and the multiplier to find the overtime payment amount

Find this overtime calculator useful?

Use the other free payroll calculators to make your life easier

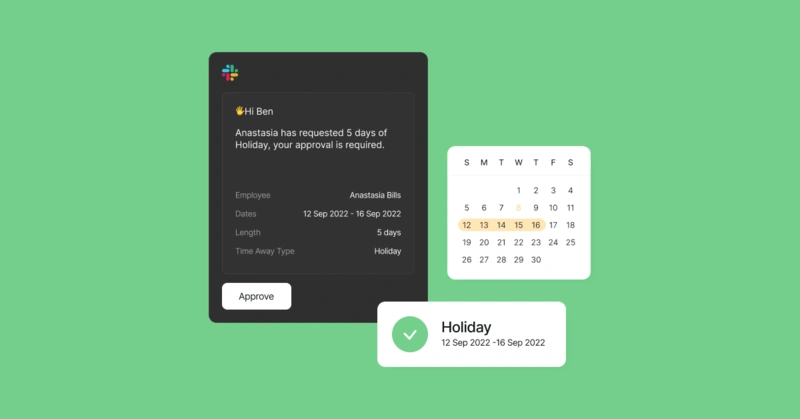

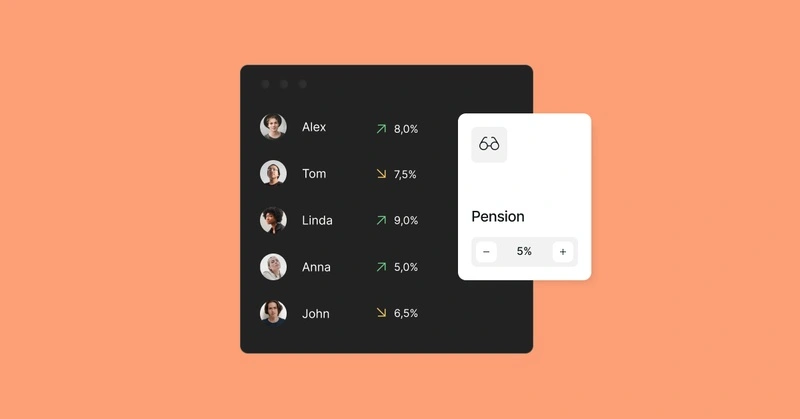

- How to calculate holiday pay in UK 2025?

- Work Hours Calculator

- How to calculate statutory sick pay leave in UK 2025

- Employer NIC calculation

Checkout this other useful guides relating to overtime pay

- Overtime: your rights

- Overtime Laws: Employee Rights

- What is Time Off in Lieu (TOIL) and how to manage it successfully

Frequently Asked Questions

How do I calculate my overtime?

To calculate your overtime, first multiply your regular rate of pay by 1.5, and then multiply the result you get by the total number of overtime hours worked.

What does "exempt status" mean?

Exempt status means that an employee is not entitled to receive overtime pay, even if they work more than the standard hours. This status is usually given to professionals or managers whose roles involve higher levels of responsibility.