Company Car Tax Calculator for Employers & Payroll Teams

If you’re an employer or HR/payroll team managing company cars, calculating the correct tax can be confusing due to CO₂ emissions, car value and changing BIK rates. Even small mistakes can lead to compliance issues and penalties.

But this company car tax calculator helps employers and payroll teams quickly estimate company car tax accurately. It makes it easier to stay compliant, plan payroll costs and report correctly to HMRC.

| Setting | Value | Unit |

|---|---|---|

|

Tax year

Car via salary sacrifice (OpRA)

Annual salary foregone

|

|

—

—

£ per year

|

|

Available from

Available to

Days unavailable (30+ consecutive)

|

|

—

—

days

|

|

List price (P11D)

CO2 emissions

Electric range (if 1–50g/km)

Fuel type

Employer pays for private fuel

|

|

£

g/km

miles

—

—

|

|

Capital contribution (max £5k)

Private use payment

|

|

£

£ / month

|

| BiK rate | — | % |

| Car benefit charge | — | £ per year |

| Fuel benefit charge | — | £ per year |

|

Tax liability (20% band)

Tax liability (40% band)

|

—

—

|

£ per year

£ per year

|

| Note: Simplified estimate; BiK bands and fuel multipliers vary by tax year and vehicle details. | ||

Talk to an expert

Speak to us to learn how you can integrate your benefits offering with payroll.

How to Use our Company Car Tax Calculator

Our Company Car Tax Calculator is designed to be quick and easy to use.

What you need to enter (inputs):

- Select the car model

- Choose the fuel type

- Pick a derivative/version of the car

- Add any capital contribution (one-off payment)

- Enter private use payments (if applicable)

What the calculator shows (outputs):

- Car CO₂ emissions

- BIK tax per year (based on 20% income tax rate)

- List price of the vehicle

- Total estimated company car tax per year after adjustments

Once you select a vehicle and enter your contributions, the calculator instantly shows how much company car tax you’ll pay annually, helping you compare options and choose the most tax-efficient company car.

What Is Company Car Tax?

You know that feeling when your company hands over a shiny new car, and your first thought is… “Cool!”, but then reality hits. Because yeah, that car isn’t just a perk; it’s a taxable benefit. That’s right. Even if it feels like a gift, the government sees it differently.

Company car tax is a tax applied when an employee can use a company-provided car for personal trips. HMRC treats this as a benefit in kind (BIK), which means it’s considered extra income. Employers are responsible for calculating it, reporting it and including it correctly in payroll. A company car tax calculator is a tool that helps employers and payroll teams quickly estimate how much tax is due on a company car.

So, as an employer or HR/payroll pro, your job isn’t just handing over keys. You’ve got to track who’s driving what, how much it’s worth and make sure it’s all reported correctly. Think of it like keeping a tidy bookshelf: it’s not glamorous, but it saves you from tripping over chaos later.

Who Needs to Calculate Company Car Tax?

Calculating company car tax isn’t just a “once-a-year” task for the accountants; it requires coordination across several departments to ensure HMRC compliance and accurate budgeting.

- UK employers providing company cars: Whether you have a fleet of 50 or a single vehicle for a director, you are responsible for calculating the benefit value and reporting it.

- HR & payroll teams: These teams need the exact figures to adjust tax codes or process “payrolling” of benefits, ensuring the correct amount is deducted from employee paycheques each month.

- Finance teams managing benefits: To understand the “Total Cost of Ownership,” finance must forecast the 15% Class 1A NIC liability that the company will owe at the end of the tax year.

How Company Car Tax Is Calculated in the UK

Honestly, the calculation is a bit of a jigsaw puzzle. You’ve got three or four pieces that have to click together before you see the actual price tag. Think of it as a sliding scale: the more the car costs and the more it “hurts” the environment, the more HMRC wants a piece of the action.

Here are the levers you’re pulling:

- The P11D Value (The “Sticker” Price): This isn’t just what you paid for the car after a cheeky discount. It’s the list price, including VAT and any of those fancy extras like heated seats or a better sound system. Basically, if it’s on the car when it’s delivered, it’s in the value.

- CO₂ Emissions: This is the big one. Every car has an emissions rating. The higher that number, the higher the BiK (Benefit-in-Kind) percentage. For 2026, even the “clean” cars are seeing their rates creep up a bit.

- Fuel Type: Is it a petrol? A diesel? Or a full electric? HMRC loves electric cars right now (the rate is only 3% this year), but if you’re running an older diesel that doesn’t meet specific standards, they’ll tack on a 4% surcharge just to be annoying.

- The Employee’s Tax Band: This is where it gets personal. The tax isn’t a flat fee. If your employee is a higher-rate taxpayer (40%), they’re going to pay double what a basic-rate taxpayer (20%) pays for the exact same car.

Here’s the “napkin math” version of how it looks:

Take the P11D value $\times$ the BiK % (based on emissions). That gives you the “Total Benefit Value.” The employee then pays their tax percentage on that amount.

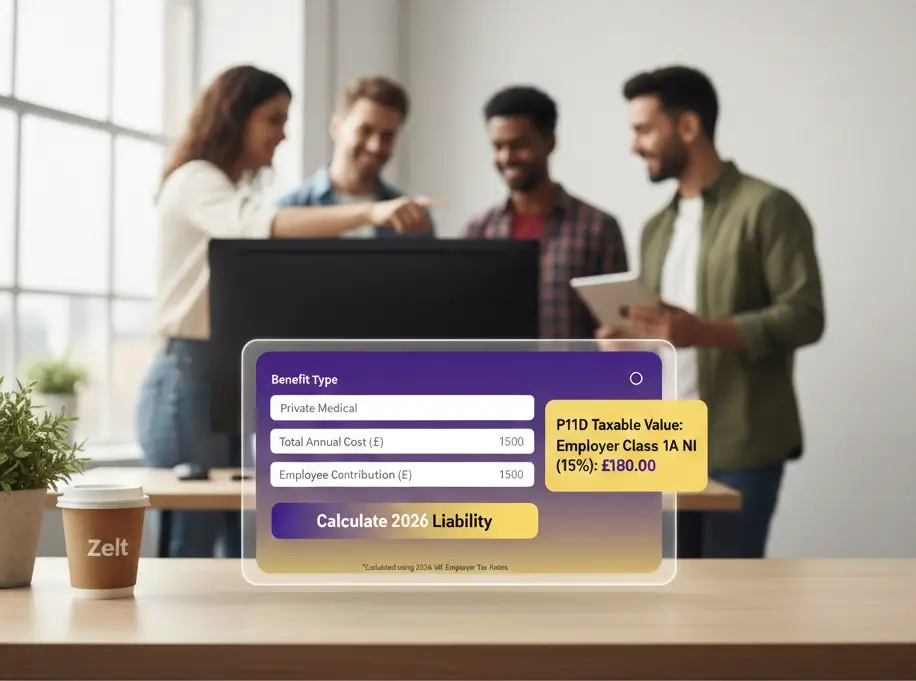

If you want to see exactly how this works for each employee and vehicle, try our P11D Calculator, which instantly determines reportable values and Class 1A NIC.

A quick aside: As an employer, you don’t just sit back and watch. You have to pay Class 1A National Insurance on that same benefit value. At 15%, that’s a cost that can really sneak up on you if you aren’t tracking it.

Company car tax is calculated using Benefit in Kind (BIK) rules based on CO₂ emissions and list price. To calculate BIK values across different benefits and compare tax years, you can also use our Benefit in Kind calculator.

Why Accurate Company Car Tax Calculation Matters for Employers

Look, I get it. You’ve got a million things on your plate, and “double-checking BiK rates” sounds like a chore for Future You. But getting this wrong is one of those things that starts as a tiny ripple and turns into a tidal wave later on.

Think about it: if you mess up the calculation, you’re not just potentially getting a stern letter from HMRC. You’re actually affecting your team’s take-home pay. Nobody wants to be the person explaining to a top performer why they suddenly owe £1,200 in back-dated tax because the car’s emissions were logged incorrectly.

Then there’s your side of the ledger. With Employer National Insurance sitting at 15% this year, an “oops” in the car’s value means you’re underpaying (or overpaying) your own taxes. Accuracy isn’t just about being a “good student” for HMRC; it’s about protecting your cash flow and keeping your employees from having a nasty surprise on their P60.

Employer Responsibilities for Company Car Tax

If you provide the wheels, you provide the paperwork. That’s the deal. But it doesn’t have to be a nightmare if you know the rhythm.

- The Big Report: You’ve got to tell HMRC about these perks. Traditionally, this was the P11D form (due by July 6th), but honestly, the world is moving toward Payrolling Benefits. It’s much cleaner, you just handle the tax through the monthly payroll like everything else.

- Records are everything: Keep a “source of truth.” You need the list prices, the CO₂ specs, and exactly when an employee handed back the keys. If someone swaps an SUV for an EV halfway through the year, you need that date.

- The Deadlines: Don’t let the dates sneak up. You’ve got P11Ds in July and the Class 1A NIC payment in late July. If you’re payrolling, you’re doing it bit-by-bit every month, which usually feels a lot less painful.

Company Car Tax vs Salary Sacrifice

You’ve probably heard people buzzing about Salary Sacrifice lately. It sounds fancy, but it’s actually a pretty simple trade.

An employee says, “Hey, take some of my pre-tax salary and give me an electric car instead.” Because that money is taken out before tax, they save a fortune on Income Tax and NI.

The catch? They still have to pay that Company Car Tax (BiK) we talked about earlier.

The win? If the car is electric (3% BiK right now), the tax they pay is tiny compared to the tax they saved on their salary. For you, as the employer, it’s often a “cost-neutral” way to give your team a huge pay rise in the form of a shiny new Tesla.

| Feature | Standard Benefit | Salary Sacrifice |

|---|---|---|

| How it works | Added on top of salary | Swapped for pre-tax salary |

| Income Tax & NI | No change | Significant savings |

| Company Car Tax (BiK) | Paid by employee | Paid by employee |

| Employer NI Cost | Increases | Decreases (Cost-neutral) |

| Best for… | Essential business tools | High-value perks (like EVs) |

Common Company Car Tax Mistakes Employers Make

Even the pros trip up sometimes. Here are the “classic” ways things go sideways:

- Using the “Price Paid” instead of P11D: You might have got a 10% discount from the dealership, but HMRC doesn’t care. They want the tax based on the official list price.

- Forgetting the Fuel: If the company pays for private fuel (commuting, grocery runs), that’s a separate tax charge. It’s expensive, and often, it’s actually cheaper for the employee to just pay for their own petrol.

- The “Ghost Car”: An employee leaves, the car sits in the car park for three months, but no one tells Payroll. You’re still paying tax on a benefit nobody is using.

Simplify Tax & Admin with Integrated Payroll

Do you really want to spend your week as a part-time tax consultant? This is where a platform like Zelt All-in-one-hr software steps in. Instead of you manually syncing spreadsheets or chasing HMRC updates, the system just… knows.

By linking HR, benefits, and payroll in one place, any change to an employee’s package, from a new health plan to a pension adjustment, flows automatically into their pay. It turns a week-long administrative headache into a five-minute check, ensuring your data is always accurate and your company stays compliant.

Frequently Asked Questions

Do employers pay company car tax?

Not the "Income Tax" part, but you do pay Class 1A National Insurance on the value of the car. It’s currently 15%.

Is company car tax paid monthly?

Usually, yes. HMRC adjusts the employee’s tax code so the tax is spread across the year, or you "payroll" it monthly.

re electric cars taxed?

Yes, but they are the "teachers' pet" of the tax world. The rate is only 3% for 2025/26, which is a fraction of what you'd pay for a petrol car.

Is company car tax a payroll deduction?

Technically, it's tax on a benefit, but it manifests as a deduction from the employee's net pay because their tax code gets lowered.