Pay your team with bulk payments in a few clicks

Keep all your payments in the same place and minimise the risk of human error by having everything you need in one place with the Zelt payments app. From calculating student loans to wiring payments in batch for the entire team at once, payday has just become much easier.

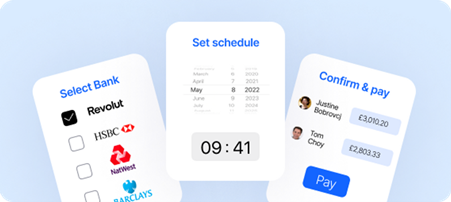

Integration with most UK banks

Zelt has integrations with most major UK banks, so you can start making payments straight away, without any set up from your end from your company’s bank account. Some banks allow you to set execution dates in the future, so you can create and authorise payments in advance and just set them to be automatically made on the exact day you schedule them on.

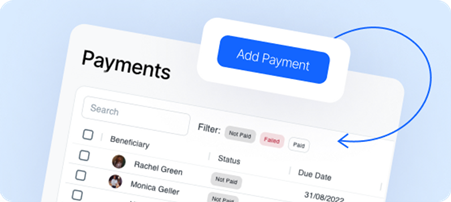

Easy to filter, toggle and view

Having to type in all the separate payments manually in your banking app or having to rely on reformatting CSVs is a very admin heavy task that takes a lot of time and is very prone to human errors that can lead to a significant drop in employee satisfaction and task. Not to mention all the other implications of having to address those errors. In the Zelt payments app, you can keep track of due dates for salaries, expenses and invoices for all your employees in one place where you can filter everything by names, due date or the state of the payment.

Integration with the Zelt payroll app

When running payroll with Zelt, your salary payments for each of your employees, as well as the contributions made to HMRC will appear under the Payments section. You can easily check which payments have been made and which payments are still pending in the same place.

After the successful completion of that month’s payrun you will be redirected to the Payments app where you can select multiple payments and mark them as paid.

How it works

Adding a payment

- Make sure that this employee has their up-to-date bank details completed in their profile.

- Go into your payments app, click on “Add a payment”

- Select any employee to whom you would like to make a payment to;

- State the amount that will be wired and any reference. Bear in mind that some banks have a limit on the length or reference (often up to 35 characters).

- Select Payment type: Expenses, Invoice or Payroll

Making the payments

- Select the payments you want to make

- Click on ‘Pay’

- Select your bank – different banks have different restrictions listed at the end of the article

- Select the execution date – some banks will allow you to set the payment date in the future if you are not ready to wire the money now

- Confirm payment – before processing your payment is to review and confirm your wires. All of your employees’ information that is required for the payment will be synced from their profiles so you don’t have to worry about filling anything out.

- Make the payment – this will redirect you to your chosen bank for authentication and once it’s all done you will be able to come back to Zelt and see that your payments have now been completed and they will disappear from the pending payments table.

Frequently Asked Questions

Which UK banks allow bulk payments?

The banks that allow bulk payments are:

- Allied Irish Bank Business (ROI)

- Barclays Business

- Barclays Corporate

- HSBC UK Business

- Lloyds (Business)

- Natwest Bank

- Natwest Bankline

- Royal Bank of Scotland

- Royal Bank of Scotland Bankline

- Santander UK Business

- Silicon Valley Bank

- Revolut

What are the restrictions that apply to bulk payments on Zelt?

- Barclays

- Only immediate domestic payments are supported

- Maximum 50 payments per request

- Minimum 5 payments per request

- Minimum total payments amount is £1.00

- Maximum total payments amount is £50,000

- A reference for every payment is required

- HSBC

- Only scheduled domestic payments are supported

- Does not support FPS but uses BACS (Direct Debit + Direct Credit)

- All payments must have a payment execution date 2–45 days in the future

- Lloyds

- Only immediate and scheduled domestic payments are supported

- Maximum 25 payments per request

- Minimum total payment: £0.01 (1p)

- Maximum depends on account limits

- Scheduled payments are not accepted

- A reference for every payment is required

- Natwest

- Only immediate and scheduled domestic payments are supported

- Maximum 15 payments per request

- All payments must have the same payment type

- Only accepted for trusted beneficiaries (added as payees)

- RBS

- Only immediate and scheduled domestic payments are supported

- Maximum 15 payments per request

- All payments must have the same payment type

- Only accepted for trusted beneficiaries

- Santander

- Only immediate and scheduled domestic payments are supported

- Maximum 1750 payments per request

- Only accepted for trusted beneficiaries

- Silicon Valley Bank

- Maximum 200 payments per request

- Only immediate and scheduled domestic payments supported

- If execution date is today but outside 04:30–16:30 UTC or on a weekend, payment is rejected

- Future-dated payments allowed on weekends or outside cutoff

- Revolut

- Only immediate domestic payments are supported

- Payees must be trusted beneficiaries on the payer account

- Payee address card is required for each payment

- Bulk payments only authorised via web (not mobile app)

- Limit of 1000 payees per bulk payment

What type of payment should I select?

Here is a breakdown of all the types of payments available in Zelt:

- Expenses – Reimburse employees for job-related out-of-pocket costs (e.g. train tickets). These can be included in monthly payroll or paid immediately via the Payments app.

- Invoices – Pay contractors or external workers not on payroll. Tax responsibilities are handled by the receiver.

- Payroll – Salaries and tax payments to authorities like HMRC. These should not be created manually but generated from the Salary app after payroll runs.